Disclaimer: The information provided in this article is for general information purposes only and does not constitute financial or investment advice. Although the content has been prepared with the utmost care, we assume no liability for the accuracy, completeness and timeliness of the information provided. Any action you take on the basis of the information contained in this article is entirely at your own risk. We recommend that you seek professional financial advice before making any investment decisions.

Quarterly figures next week

I now always call up my quarterly figures on this free tool, the best overview on the net: https://aktienfinder.net/earningskalender

My current investments (always up to date): https://de.tradingview.com/watchlists/50866449/

My current watchlist (always up to date): https://de.tradingview.com/watchlists/50866935/

Stock Market Outlook: Bulls in the Driver’s Seat! Are Bears Still Relevant?

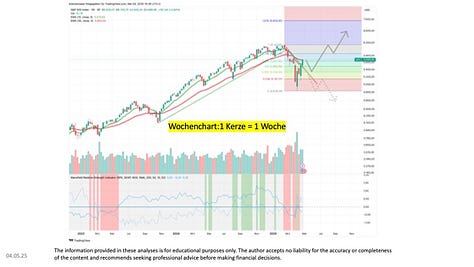

April 2025 was a “hammer” in the truest sense of the word. The monthly S&P500 candle for April dipped very low but was bought back up in record time. Buying interest was so strong that it even “saved” the steep uptrend from March 2020. This movement created a new support zone between 5,000 and 5,500 points on the monthly chart.

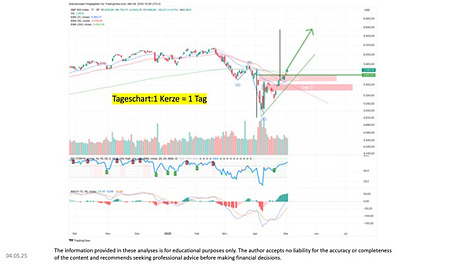

What’s key now is getting another weekly close in May above the 5,650 mark. Around the 30-week moving average, or just above the 200-day moving average, I expect a brief pause – but buying pressure is so high that we could then run toward the all-time high. If the market were to push straight to a new all-time high, I’d view that negatively, since it would mainly reflect retail investors’ fear of missing out.

A moderate May, on the other hand, would reinforce the daily chart’s target of 6,571 points. The old adage “Sell in May and go away” would likely be the wrong strategy in 2025. That target is derived from the height of the triangle formed by the descending and ascending trendlines.

The Nasdaq 100 is painting a similar picture to the S&P 500. The U.S. market still isn’t showing any relative strength compared to Europe. Here too, I expect a gap fill over the course of the month, followed by a test of the all-time high. The big question is whether taking on U.S. dollar risk will be worth it again for me as a European investor. Many say that worries about the U.S. dollar have already passed, but why should I take that risk if I can make money in my home currency?

The STOXX 600 has managed to maintain its relative strength despite the U.S. market’s sharp rebound. I also consider a gap fill likely in the European indices. For the DAX, that would mean a pullback to around 21,600 points, before subsequently charging to a new all-time high. I see the 26,000-point level as a realistic target for 2025.

My favorites remain the German MDAX and SDAX indices, from which I primarily draw my investments. However, I’m not losing sight of the Nasdaq 100, since, for example, semiconductor stocks showed positive momentum this week. If things continue like this, I’ll be buying into corrections again – under the broad theme “Small- and Mid-Cap Infrastructure Europe/Germany”.

Of course, one shouldn’t succumb to euphoria in these positive scenarios. At the moment, however, skepticism – the proverbial “wall of worry” – dominates, and many investors are acting cautiously. Trading volumes are a bit thin at times, and a comeback of political risks is possible at any time.

I therefore have risk hedges in place in the market. However, it’s important to also set a limit on stop-loss orders to avoid getting burned by overnight moves at the start of trading.

Cryptocurrencies / Bitcoin – Heading Toward All-Time High, Altcoins Attractive

In the cryptocurrency market, the situation is pleasantly uneventful: Bitcoin continues to head toward its all-time high and remains relatively strong compared to stock indices. If this trend holds through the week, I will ramp up my crypto allocation to nearly 100%. The theory that altcoins develop more dynamically than Bitcoin is supported by the market capitalization of the “Total3” index (excluding Bitcoin & Ethereum). The downtrend in this market cap index has also halted. As a result, I will further expand my altcoin positions.